open end lease meaning

Open-end leases allow the lessee the one who borrows the vehicle to guarantee a value at the end of the lease. Open-End Lease Law and Legal Definition.

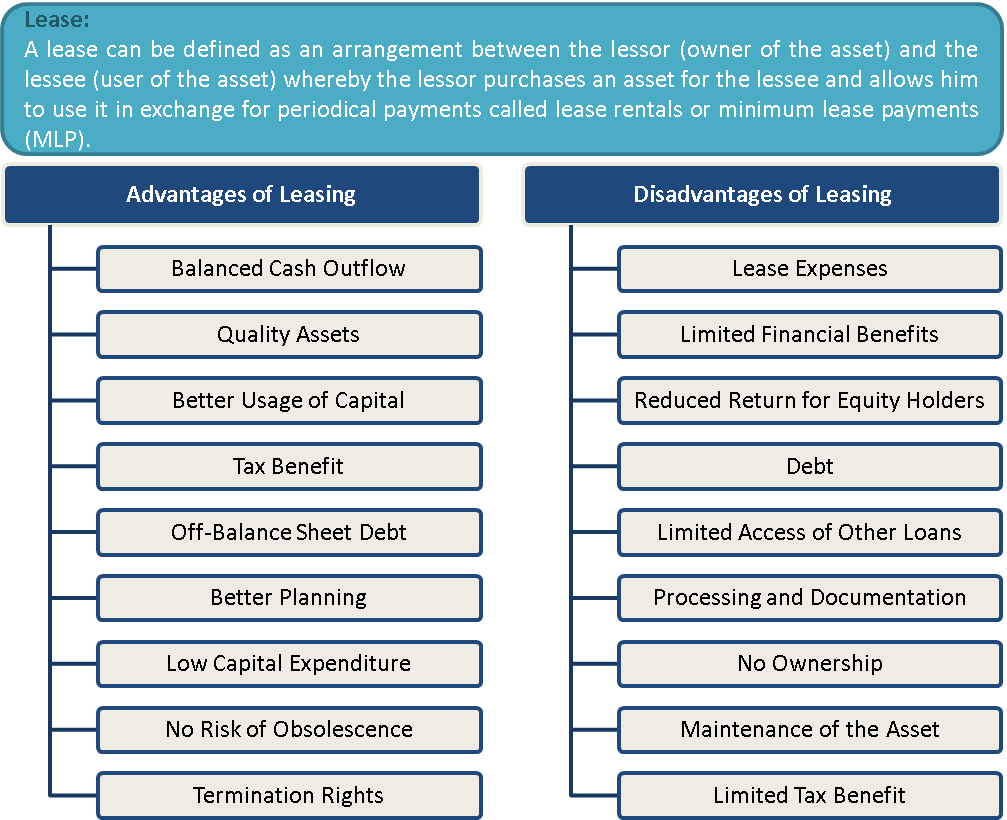

What Is Leasing Advantages And Disadvantages Efinancemanagement

Regulation M the term open-end lease means a consumer lease in which the lessees liability at the end of the lease term is based on the difference between the residual value of the leased.

. This payment scale is public when the lease terminates. An open-end lease and a closed-end lease. A lease agreement that provides for an additional payment at the expiration of the lease to adjust for any change in the value of the property.

This is called the Guaranteed Residual Value GRV and is outlined in the lease contract. You can return the vehicle and either receive a credit or a bill for the difference between what you owe and how much the vehicle is sold for. Open-End TRAC Terminal Rental Adjustment Clause Lease.

If the realized value is greater than the residual value the lessee may receive the difference subject to prior agreement. In an open-end lease more common in business leasing the person or company leasing the vehicle takes on that risk but leasing terms may be more flexible. Open-ended leases will usually allow for an annual mileage allowance greater than the average 12000 miles of a typical lease and the residual value may be set as being.

This works well for employers since the cost of the vehicles can be written-off or expensed. What is Open-End Lease. Your rights and obligations at lease-end are different in an open-end lease and a closed-end lease.

After this period the lease may be terminated at any time without penalty. With an open end lease the lessee is basically assuming the risk of the equipment items being leased depreciating in value during the leasing term. Many wonder what is an open end lease.

Monthly payments are usually lower than the grant of hired purchase the purchase lease requires large payments when maturing. There are typically two types of leases. You are given a value as to the estimation of what the value of the hardware will be at the end of the lease.

In contrast to the open-end lease most retail lease contracts represent closed-end operating leases. The lease contract usually a car or means of transport in which payable payments completely debt. The employer takes all the financial risk.

Basically your equipment has a set value when it is first leased to you. For every business owner who has ever wondered what is an open end lease there is a umber of different kinds of leases to know about one of which is the open lease. A lease that provides at expiration the opportunity for the lessee to purchase the car or to extend the lease term.

An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. A lease in which the lessee guarantees the lessor the difference between the residual value of the leased asset and the value realized from the assets sale at lease termination is an open-end lease it thus exposing the lessee to residual value risk. In a closed.

When you lease a car youll usually be offered a closed-end lease. The risk in this case is really referring to the potential for commercial equipment items to depreciate in value over the course of a leasing term. In an open-end lease you are responsible for the vehicles value that is any deficiency between the realized value and the residual value.

Over time the value drops whether its because of how you take care of the hardware or just because it is older and outdated. An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease. This type of lease means that you the lessee are responsible for the difference between the estimated residual value of the leased vehicle and its true market value when its time to turn the car in.

In a closed-end lease the leasing company takes on the risk of any additional depreciation. Open-ended leases allow landlords and tenants to change the conditions of their lease agreements with a 30-day written notice unless otherwise specified. Lease of an automobile.

If the value of the leased equipment depreciates. In an open end lease a lessee stands to be obligated to cover the potential costs of product value depreciation. In a closed-end lease at lease-end you are responsible for the condition of the vehicle that is any excessive wear and use.

This type of lease is also known as a finance lease which as the name implies permits the lessee to determine the vehicles service life after a short minimum term usually 12 months. According to 15 USCS Appx 12 CFR 2132 i Title 15. A companyemployer will assume management and leasing of the car to its employees not the leasing company.

Open-end leases also exist and are most often used in the case of commercial business lending.

What Is The Difference Between An Open Vs Closed Lease

What Is A Balloon Payment On A Car Lease Credit Karma

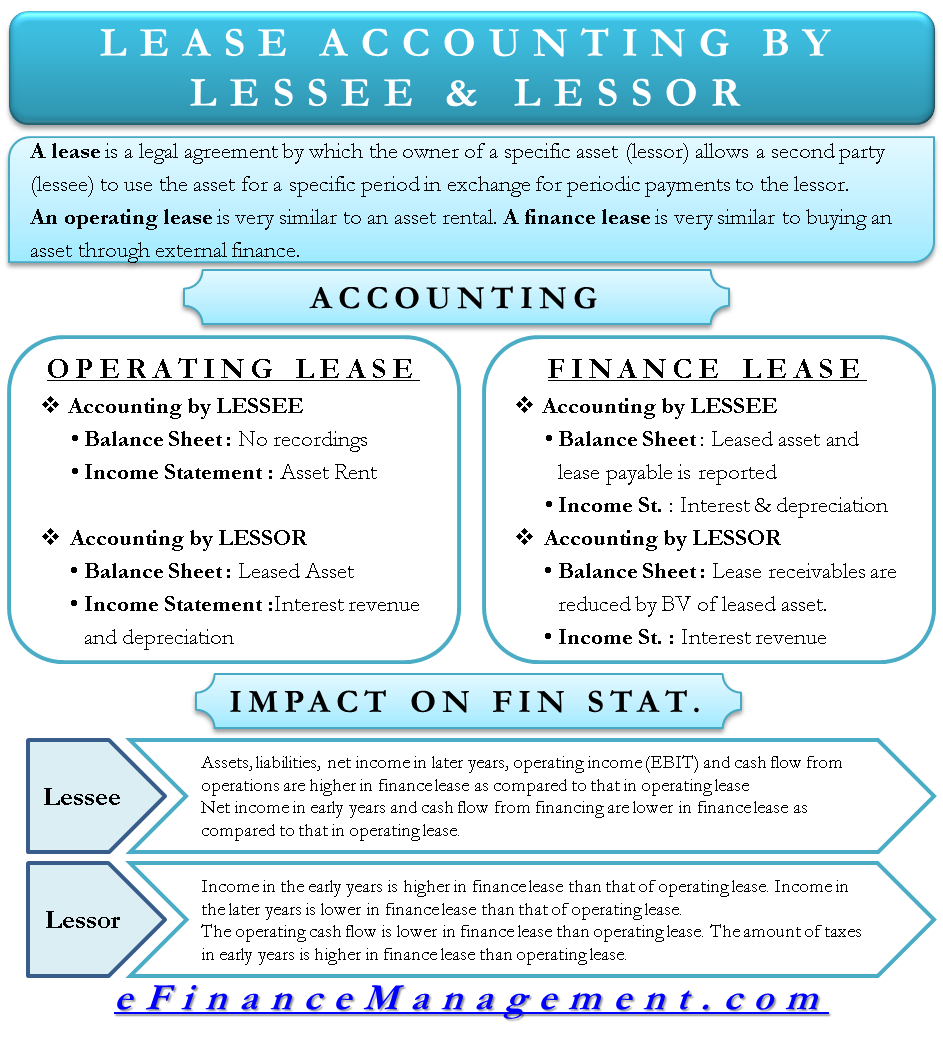

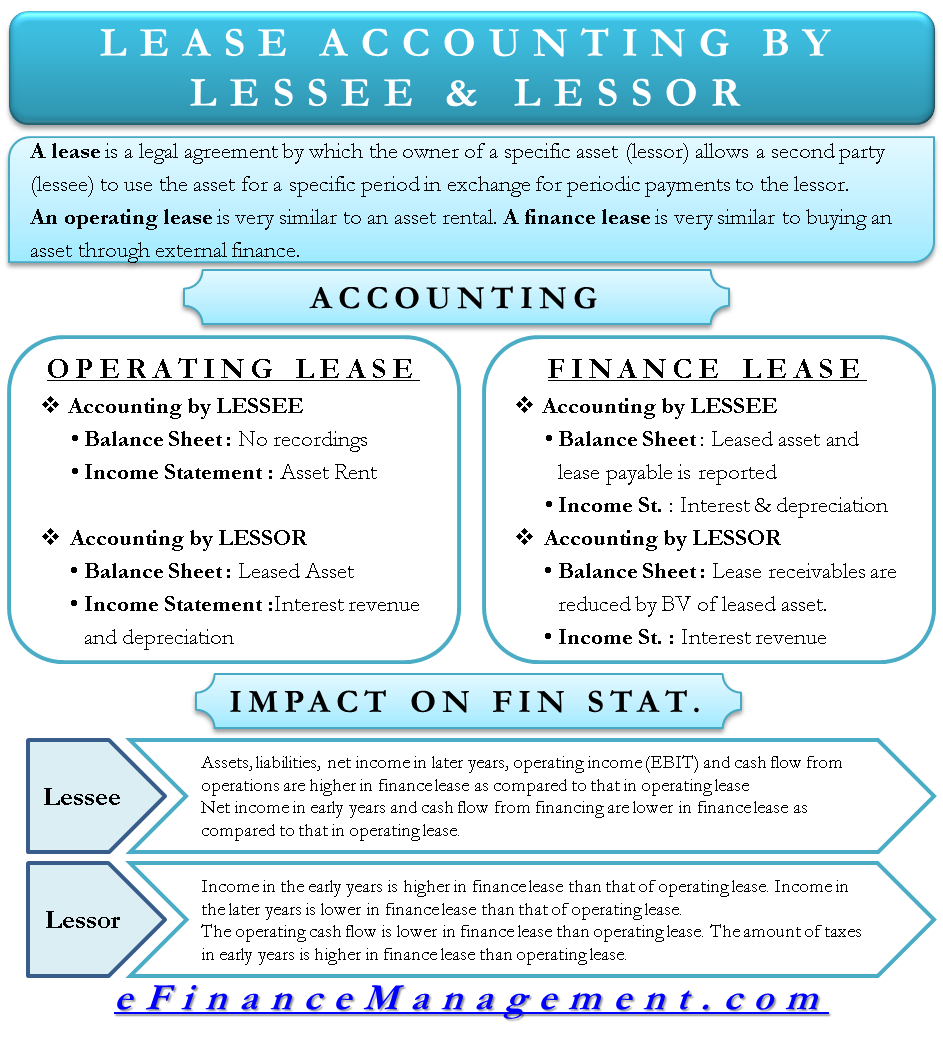

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

How To Write Letter Of Intent To Rent A Space Sample Loi For Commercial Leasing Housing News

Lease Accounting Operating Vs Financing Leases Examples

Open Vs Closed End Leases What To Know Credit Karma

What Is The Difference Between An Open Vs Closed Lease

Lease Definition Common Types Of Leases Examples

What Is Residual Value When You Lease A Car Credit Karma

How Do Car Leases Work Car Leasing Explained

:max_bytes(150000):strip_icc()/GettyImages-1285353331-36a9f19d268f4aa3bf2fe93e895a6d47.jpg)

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

:max_bytes(150000):strip_icc()/463652041-5bfc38f3c9e77c0026b8b3ac.jpg)

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

:max_bytes(150000):strip_icc()/GettyImages-185274181-80022fa82eed40ff80bf97b745b9320c.jpg)

/GettyImages-392715-0061-5bb1340a46e0fb00269fd8cd.jpg)